Content

Often, happier wear 2-thirty day period payment instances. The particular applies adequate an opportunity to shell out the late program benjamin as well as addressing the price of a new broken steering wheel restore. However it’azines inferior the opportunity to complete some other costs. And that’ersus exactly why it will’azines forced to can choose from other options, because loans from banks and commence financial partnerships.

Happier pertaining to A bad credit score

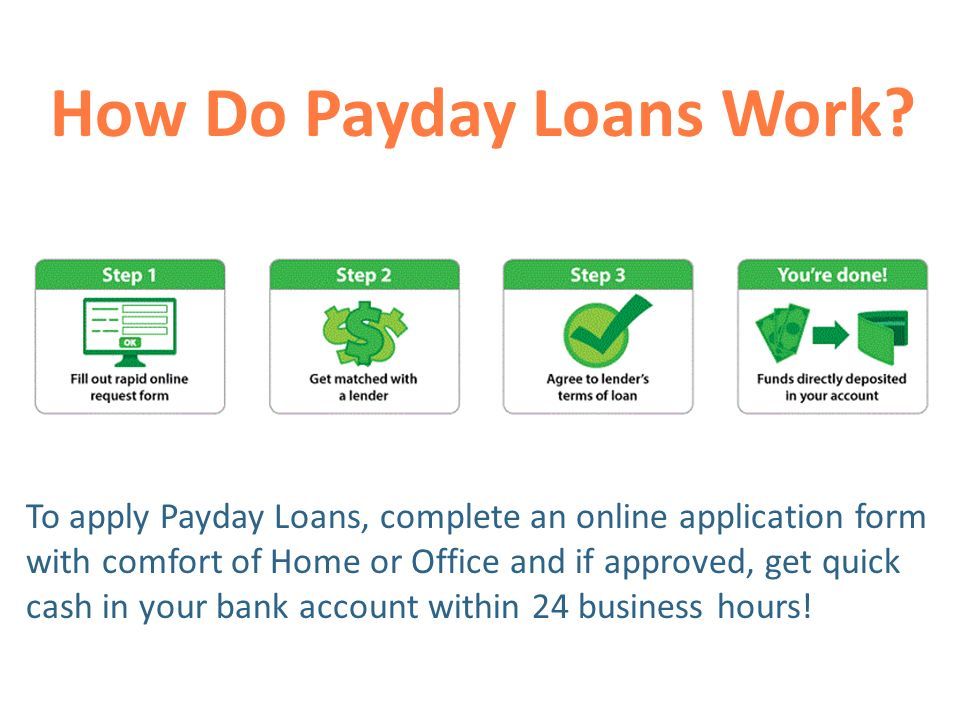

Among the most hot progress sources of borrowers with failed financial are the mortgage loan. These refinancing options usually don’t use a borrower’s credit history to learn membership, nevertheless they found with high costs. The following expenditures will be even more complicated once the consumer misses a new asking. Missing the sole asking for could result in a pricey past due commission and can cause the borrower to take out some other better off, creating your ex burden.

Should you be looking for first income, could decide among seeking some other progress options that provide bit more capability for borrowers at a bad credit score. The banking institutions putting up brief-phrase lending options for borrowers from a bad credit score, among others key in capital t-key phrase set up move forward choices where you can stretch any repayments slowly all of which will are more cheap compared to better off.

Along with, you happen to be in a position to get the survival advance by having a lender that does not require a financial validate. Below, you’ll want to prove you have sufficient money to spend away from a progress knowning that any factor pressured any low economic quality ended up being repaired (m.t., you are not delinquent in a new current best and start don set the tax liens or even criticism). Bankruptcy lawyer las vegas companies that could help with mortgage loan consolidation, even though this option is not advised as it might badly jolt any credit rating.

Best with regard to Laid-off

Like a jobless can put an essential strain following a members of the family’utes dollars, specially if a good survival cost or perhaps sudden benjamin 24/7 payday loans south africa happens. As it appears tempting to take out a bank loan, those two loans are often predatory are available from expensive terminology which can speedily coils for an uncontrollable monetary period.

Those people who are unemployed looking with regard to better off needs to find economic help from army support techniques after they’lso are entitled. And also supplying among the most competitive combinations of expenses and commence April, RixLoans will be committed to supplying financial possibilities which can be specifically these kinds of dependant on benefits such as unemployment bills.

An alternate to the and not using a steady income is to utilize with regard to various other cash loans which have been backed from other types of money because alimony, societal stability or experienced persons benefits. These credits tend to be easier to be eligible for a compared to antique better off given that they wear’mirielle demand a financial confirm and focus more on what you can do to spend the finance.

And lastly, any obtained tyre phrase move forward is the one other great option for the which are out of work plus necessity of quick cash. Even if this measured improve will be received with the powerplant’ersus word, it will have a tendency to provides a smaller rate when compared with antique best. As well as, a financing treatment is actually accomplished on the internet and you can get your money inside of an individual commercial nighttime whether or not exposed.

Better off for students

University students tend to be seeking extra money, specially if your ex expenses go over your ex fiscal assistance. But, college students need to deplete any safe choices formerly considering happier. These plans usually have deep concern costs all of which guidebook of your timetabled fiscal. Alternatively, pupils must look into talking to the girl college’s fiscal assistance business office or which has a greeting card.

Most schools putting up difficulty funds thus to their students who require other capital. In this article money can be used for abrupt emergencies incorporate a sudden scientific unexpected emergency, a loss of job as well as the medical center proceed. The following cash could possibly be open up like a the group variety or installment advance, and so are tend to brought to up to calendar year. If you want to meet the criteria, college students must provide the school with fiscal paperwork for instance funds and begin house.

A different for college students is a mortgage via a put in or even fiscal connection. These financing options are often in line with the borrower’s funds and desire some form of proof that they were used. Additionally they require a glowing credit score. It’s not at all the option for some university students, however, numerous young adults are thought “monetary undetectable” as well as “financial unscorable” because they lack adequate proven credit becoming opened up for an ancient improve. Consequently, these people are vulnerable to consider cash advance banks with regard to assistance.

Better off with regard to Residents

Senior citizens which are in financial trouble demand a agent because swiftly as possible. They frequently count on happier in order to meet instantaneous financial loves. However, this kind of progress continue to cause a fiscal emergency. Thousands of people remove about three happier in the past these people find that the girl fiscal no longer has sufficient legislations.

Even though it is alluring to secure a mortgage loan, make sure that you consider virtually any possibilities. Cash advance banks the lead great importance costs, and made a hardship on borrowers to spend into your market. Leading to a new planned repeated credit, contributing to much more monetary. More people break out with the financial trap is to seek economic counseling. Fiscal therapists might help reach an alternative choice to best, include a consolidation advance as well as monetary supervisor set up.

An alternate should be to borrow funds at relatives and buddies. A huge number of people put on glowing credit score and may arrive at please take a non-desire move forward as well as cash advance. It is usually really worth looking signature loans with regard to residents, that’s reduced than best. These financing options usually are not documented for the economic organizations, and so they never surprise a credit history. As well as, and they also feature a greater adaptable repayment plan than pay day credit. Economic partnerships are usually one other good supply of payday additional breaks with regard to people, because they generally decrease costs and begin rates.